It’s natural to feel uneasy when your super balance drops. But it’s also important to remember that downturns are part of the cycle of investment markets. While it can be tempting to switch your investments when markets are down, this has its own risks.

Panicking can be costly

During a downturn, some investors scramble to sell out of share markets to cut their losses.

But how do you know when to sell, and more importantly, when it’s ‘safe’ to buy back in? The answer: you don’t, and this is where it gets risky.

Switching investments in volatile markets (or ‘panic switching’) can mean locking in losses you’ve already incurred. For a long-term investor, it also necessitates a second decision: when to switch back. Markets have historically recovered after falls, but it’s hard to predict when a recovery might occur. It’s often only with hindsight that we can tell when the market has reached the bottom. A bounce-back can be very sudden, and you might not know whether you’ve waited too long until after the recovery has occurred.

What’s the best choice?

What’s right for one person may not be right for another, it depends on your own circumstances. Changing to a lower-risk strategy might bring peace of mind in the short term, but these generally have lower returns over longer periods.

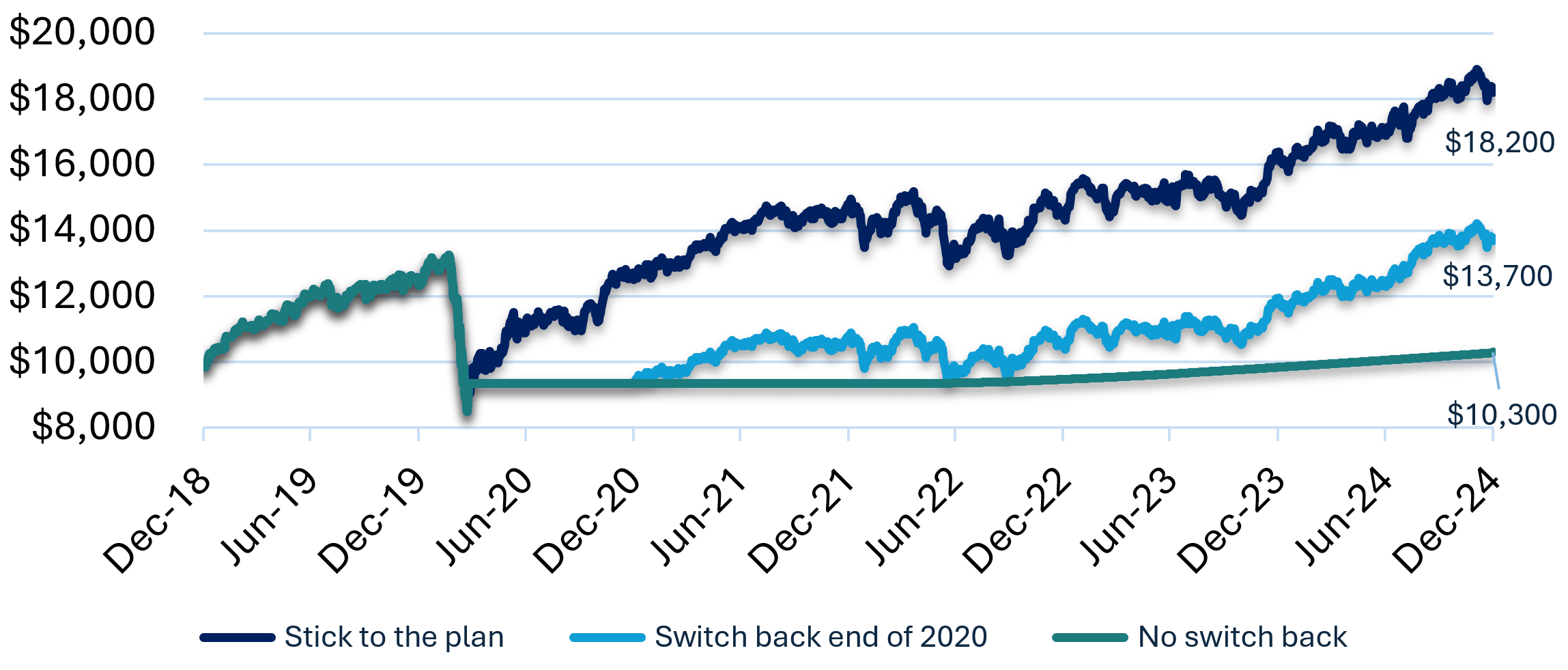

Let’s consider three investors with $10,000 in Australian shares as of December 2018. The below chart shows how much money they’d each have six years later depending on whether they chose to:

- maintain their allocation to Australian shares

- switch to cash within the first month of the COVID-19 crash and then switch back to Australian shares at the end of 2020

- switch to cash within the first month of the COVID-19 crash and remain in cash.

In this scenario, sticking to the plan generated a higher return over the period because it allowed the investor to benefit fully from the Australian share market recovery following the crash.

Ask “why” before you make an investment choice

When considering your investment strategy, it’s important to ask yourself “why am I investing?”

If you’re many years away from accessing your super, you should think about your strategy over that long-term time frame. Remember that while markets sometimes have bad years, they have generally performed positively over the long term and have rewarded investors who were able to stay the course—but it takes a bit of patience.*

Everyone’s circumstances are different and can change over time. If you think it’s time to review your strategy, help yourself to make an informed decision by looking at the range of options which we offer across the risk spectrum. These include pre-mixed options, where our fund managers choose the mix of asset classes for you, and sector options which allow you more flexibility.

When reviewing options, important details to look at might be the suggested minimum investment time frames, performance objectives, summary risk levels and what they invest in. See our investment options summaries and How we invest your money document for more information.

Want further support? We suggest seeking licensed financial advice or speaking to a UniSuper adviser who can help you navigate difficult times.

More information?

If you’re new the world of investing, read through other helpful resources like our basics of investing and investments glossary pages.

Want to keep up to date with what’s happening in markets? Listen and subscribe to our monthly investment markets podcast, including this week’s special episode with CIO John Pearce. You can also tune into his quarterly investment update videos.

-

*Past performance is not an indicator of future performance.

The information provided is of a general nature only and does not take into account your individual objectives, financial situation or needs. Consider the PDS and TMD on our website and your circumstances before making decisions, because we haven’t. Please consider the appropriateness of the information having regard to your personal circumstances and consider speaking to a licensed financial adviser before making an investment decision based on the information provided above. Visit unisuper.com.au to read the full disclaimer.

1 The S&P/ASX 200 Total Return Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by UniSuper Management Pty Ltd. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by UniSuper Management Pty Ltd. UniSuper’s products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/ASX 200 Total Return Index.

2 Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) are not affiliated with UniSuper Management Pty Ltd and do not approve, endorse, review, or recommend this report or any information included herein. BLOOMBERG and the Bloomberg AusBond Bank Bill Index are trademarks or service marks of Bloomberg and have been licensed to UniSuper Management Pty Ltd. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Bloomberg AusBond Bank Bill Index.