Markets have been volatile recently, but the good news is that markets have historically recovered after falls.* We saw this after the fall in equities in February 2020 when the COVID-19 pandemic started.

Our Investments team here at UniSuper is well placed to handle market volatility. We manage over 70% of funds in-house across all major Australian and global asset classes with deep expertise across our team, and we’re watching markets daily.

Trading off risk and return

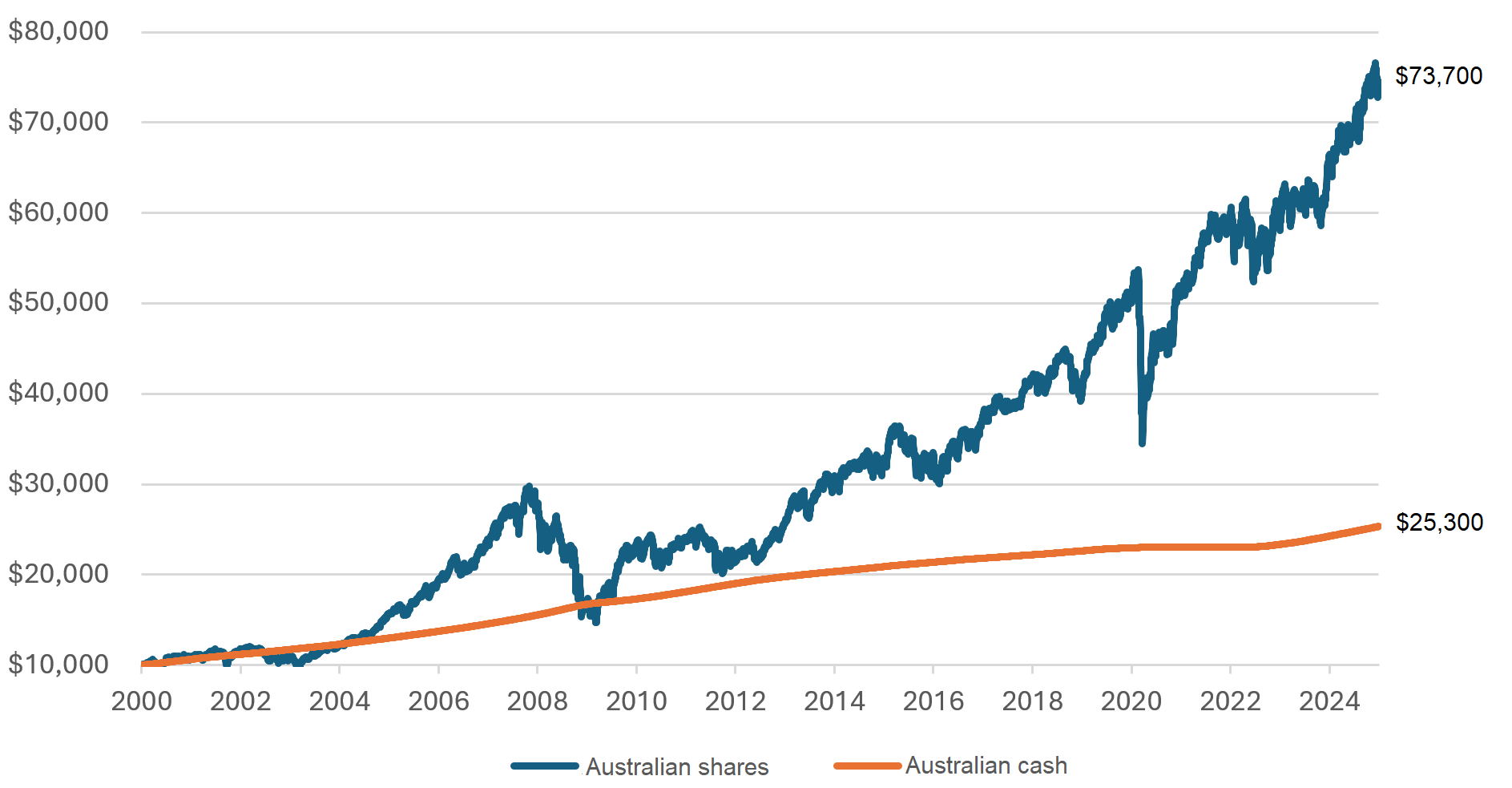

Riding the ups and downs of financial markets is part and parcel of investing. History shows that assets that are more likely to fluctuate in value over short periods generally deliver higher returns over the long term.*

Let’s compare Australian shares and Australian cash. The chart below illustrates how much money you’d have by the end of calendar year 2024 if you invested $10,000 at the beginning of 2000.

Focus on the long term

While volatility can be stressful, it’s important to take a long-term view. Even people transitioning to retirement—or who have retired—may be investing for many years. So be patient, maintain perspective and be sure to seek advice if you need it. If you’re thinking about changing your investment strategy, we have 16 investment options with different risk profiles and objectives. When choosing options, some useful questions can be:

1. How much longer will my funds be invested?

2. How much risk am I prepared to take?

3. Is my investment strategy right for me?

Before making a decision, you should read the Product Disclosure Statement and Target Market Determination. If you need help, talk to a licensed financial adviser or our award-winning financial advice team. Simply make an appointment or call us on 1800 823 842 for more information.

Stay informed on what’s happening in markets and the economy

Listen to our monthly investment podcast, in which Head of Fixed Interest David Colosimo gives a snapshot of economic and market activity. We release these podcasts at the start of each month. Subscribe via Apple Podcasts, Spotify, SoundCloud or wherever you get your podcasts. You can also visit the podcasts page on our website.

Chief Investment Officer John Pearce shares his insights in his regular investment update videos, watch his latest video.

You may also be interested in:

Retirement isn’t an ‘all’ or ‘nothing’ event. Whether you’re still working or dialling down, when it comes to your investments, the choices you make can make a difference.

-

*Past performance is not an indicator of future performance.

The information provided is of a general nature only and does not take into account your individual objectives, financial situation or needs. Consider the PDS and TMD on our website and your circumstances before making decisions, because we haven’t. Please consider the appropriateness of the information having regard to your personal circumstances and consider speaking to a licensed financial adviser before making an investment decision based on the information provided above. Visit unisuper.com.au to read the full disclaimer.

1 The S&P/ASX 200 Total Return Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by UniSuper Management Pty Ltd. S&P®, S&P 500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by UniSuper Management Pty Ltd. UniSuper’s products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P/ASX 200 Total Return Index.

2 Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) are not affiliated with UniSuper Management Pty Ltd and do not approve, endorse, review, or recommend this report or any information included herein. BLOOMBERG and the Bloomberg AusBond Bank Bill Index are trademarks or service marks of Bloomberg and have been licensed to UniSuper Management Pty Ltd. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Bloomberg AusBond Bank Bill Index.