UniSuper pension products — results are in

Every year we’re required to assess the performance of our pension products, to ensure they continue to promote the financial interests of our members. After assessment for the year that ended 30 June 2024, we found that they do promote our members’ financial interests.1

The pension products included in this assessment are Flexi Pension, which includes Transition to Retirement (TTR), and Lifetime Income.

How we shaped up

Our pension products have passed the Member Outcomes Assessment and and we've determined that they promote our members’ financial interests.

We assessed two key areas of our pension products, as prescribed by law:

- How we compare on fees and returns (Comparison matters)

- Other member benefits (Assessment factors).

Strong long-term returns5

UniSuper’s Balanced investment option was a strong performer. It outperformed the industry median over the one, three, five and seven years to 30 June 2024 — based on data sourced from superannuation research and ratings house SuperRatings.*

Here’s how our options performed.

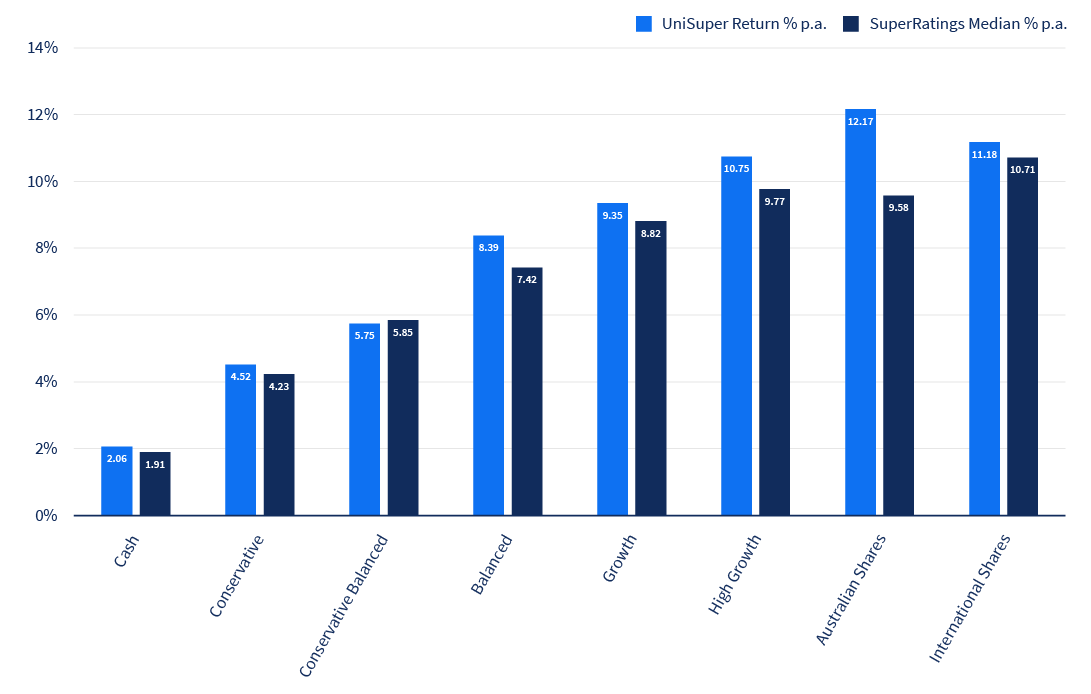

7 year investment return

This graph shows UniSuper's 7-year investment performance vs the SuperRatings median.*

Source: SuperRatings Pty Ltd Pension Fund Crediting Rate Survey June 2024, published 19 July 2024, for the appropriate index.

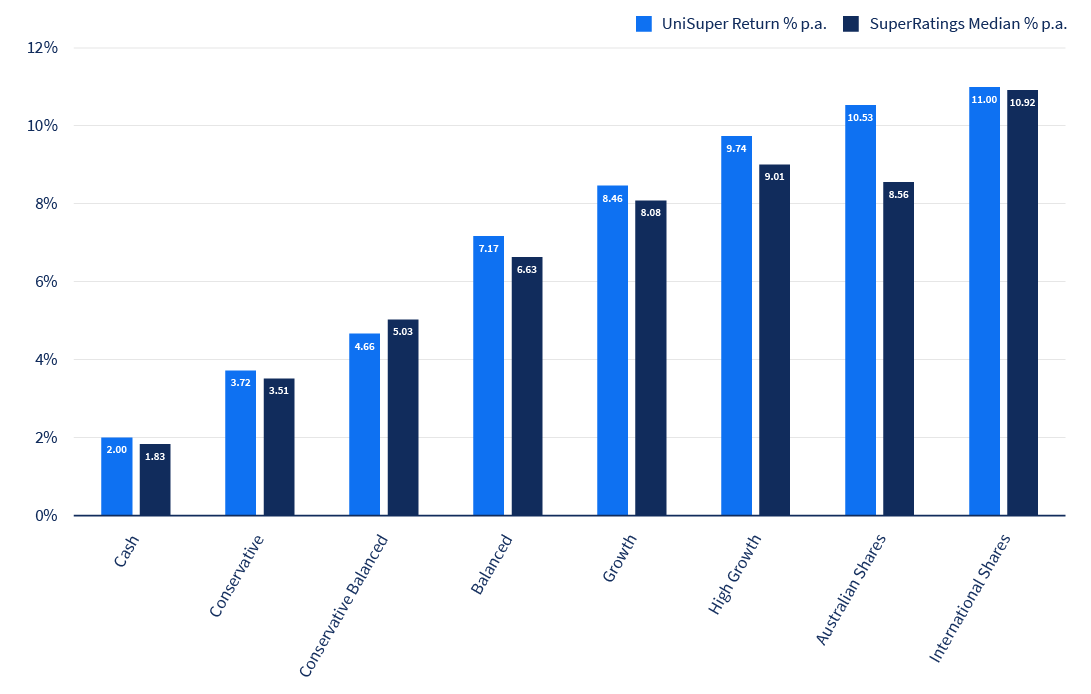

5-year investment return

This graph shows UniSuper's 5-year investment performance vs the SuperRatings median.*

Source: SuperRatings Pty Ltd Pension Fund Crediting Rate Survey June 2024, published 19 July 2024, for the appropriate index.

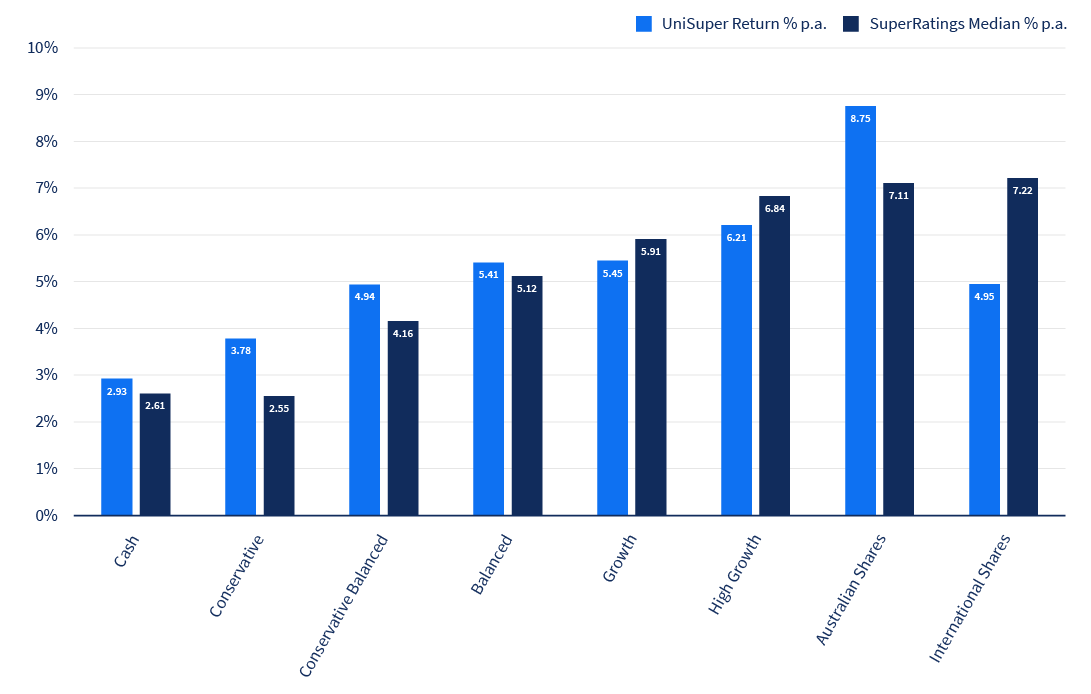

3-year investment return

This graph shows UniSuper's 3-year investment performance vs the SuperRatings median.*

Source: SuperRatings Pty Ltd Pension Fund Crediting Rate Survey June 2024, published 19 July 2024, for the appropriate index.

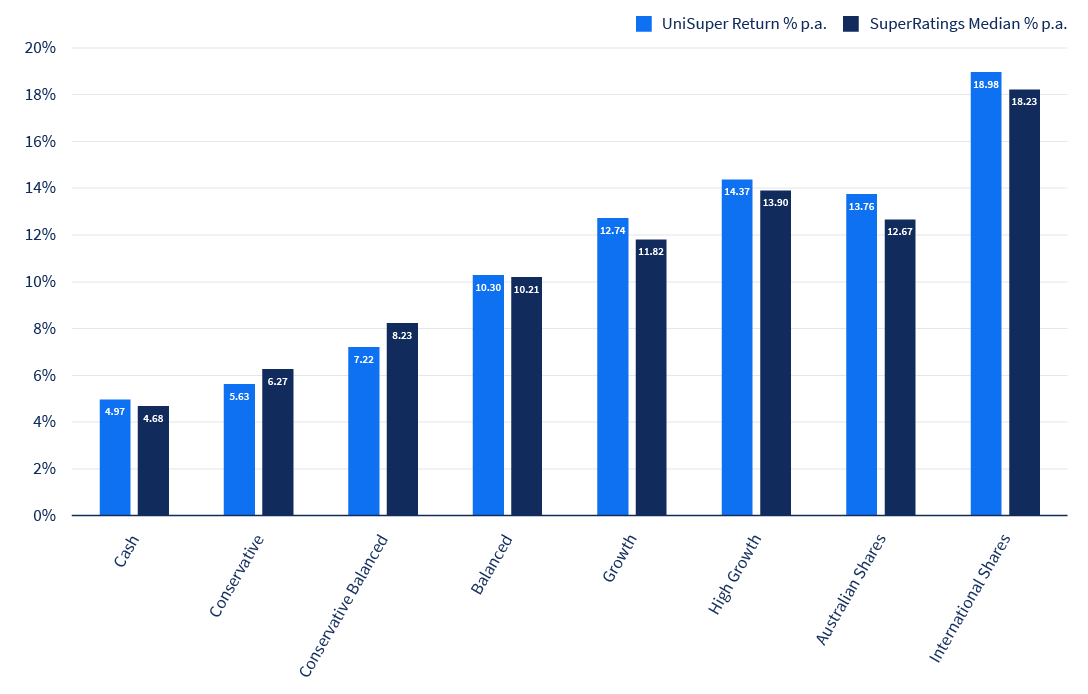

1-year investment return

This graph shows UniSuper's 1-year investment performance vs the SuperRatings median.*

Source: SuperRatings Pty Ltd Pension Fund Crediting Rate Survey June 2024, published 19 July 2024, for the appropriate index.

Competitive fees5 ^

Fees for our pension products and investment options were considered amongst the lowest in the industry, ranking in the top quartile for assessed investment options — as reported by superannuation research and ratings house Chant West. Our Flexi Pension TTR investment options were similarly ranked.4

Fees on $250,000 balance

This graph shows UniSuper's annual fees and costs compared to the industry average for a $250,000 balance.*

Source: Chant West Pension Fund Fee Survey June 2024

Fees on $500,000 balance

This graph shows UniSuper's annual fees and costs compared to the industry average for a $500,000 balance.*

Source: Chant West Pension Fund Fee Survey June 2024

Join an award-winning fund

We’re known as one of Australia’s best super funds for our record of strong long-term investment performance.* We’re proud to be consistently recognised as an award winning fund. 10

-

Things you need to know

1 Compare UniSuper with other super funds.

2 While this assessment includes our investment options mentioned on this page, we offer other investment options that have not been included due to limited availability of comparison data. More information on our full range of investment options and performance is available on our investment performance webpage.

3 Comparison of fees and returns does not apply to the Lifetime Income and Defined Benefit Indexed Pension products as these provide a lifetime income stream.

4 The TTR Flexi Pension works alongside your accumulation super account. For the comparison of the accumulation products please refer to the Accumulation products member outcomes assessment.

5 This section only applies to Flexi Pension including TTR. This is because our Lifetime Income provides an income for life which increases each year with the Consumer Price Index, regardless of the performance of investment markets. We’ve assessed the level of income the Lifetime Income provides against other similar income streams, with similar features, and determined it promoted members’ financial interests during the assessment period.

6 Although, under ‘Investment returns and fees’, we were able to compare only some of our investment options with others in the industry because of data limitations, this section applies to all of our investment options.

7 4th largest fund by total assets under management as of 30 June 2024. Source: APRA Annual Fund-Level Superannuation Statistics.

8 Sustainable and environmental investing means different things to different people. Different products have different investment criteria. Read our How we invest your money document (PDF, 1.27 MB) to find out what sustainable and environmental investing means to us and what our investment options invest in. Different products have different approaches. The Responsible Investment Certification Program provides general advice only and does not take into account any person’s objectives, financial situation, or needs. Neither the Certification Symbol nor RIAA recommends to any person that any financial product is a suitable investment or that returns are guaranteed. Because of this, you should consider your own objectives, financial situation and needs and also consider the terms of any product disclosure document before making an investment decision. Certifications are current for 24 months and subject to change at any time.

9 Lifetime Income members excepted. Alternative customer service options are available.

10 Money magazine Best Pension Fund 2023, 2024, and 2025. Canstar Outstanding Value Superannuation 2022, 2023 and 2024. SuperRatings’ 2025 Retirement Offering of the Year and 2024 Fund of the Year.

The rating is issued by SuperRatings Pty Ltd ABN 95 100 192 283 (SuperRatings) a Corporate Authorised Representative (CAR No.1309956) of Lonsec Research Pty Ltd ABN 11 151 658 561, AFSL No. 421445. Ratings are general advice only and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and SuperRatings assumes no obligation to update. SuperRatings use proprietary criteria to determine awards and ratings and may receive a fee for the use of its ratings and awards. Visit superratings.com.au for ratings information. © 2024 SuperRatings. All rights reserved.

* Past performance is not an indicator of future performance

Consider the Product Disclosure Statements (PDS) and Target Market Determinations (TMD) on our website and your circumstances before making decisions, because we haven't.

^ Competitive fees

UniSuper investment option UniSuper Flexi Pension fee ranking for $250,000 account balance UniSuper Flexi Pension fee ranking for $500,000 account balance Rank UniSuper Fees Industry average Rank UniSuper Fees Industry average High Growth 6 (out of 34) $1,896 $2,932 6 (out of 34) $3,696 $5,557 Growth 10 (out of 53) $1,946 $2,635 10 (out of 53) $3,796 $5,031 Balanced 4 (out of 62) $1,596 $2,602 4 (out of 62) $3,096 $4,977 Conservative Balanced 4 (out of 55) $1,646 $2,474 5 (out of 55) $3,196 $4,717 Conservative 13 (out of 64) $1,671 $2,197 14 (out of 64) $3,246 $4,164 Fees and Costs, Pension Products | Source: Chant West Pension Fee Survey June 2024 Chant West

Zenith CW Pty Ltd ABN 20 639 121 403, AFSL 226872/AFS Rep No. 1280401. Third-party data does not contain all information required to evaluate the nominated service providers. To the extent that any Information provided is advice, it is limited to General Advice only and has been prepared without considering the objectives or financial situation of any individual, including target markets where applicable. It is not a recommendation to purchase, sell or hold any product and is subject to change at any time without notice. Individuals should seek independent advice and consider the PDS or offer document before making any investment decisions. Data is provided in good faith and is believed to be accurate, however, no representation, warranty or undertaking is provided in relation to the accuracy or completeness of the data. Data is subject to copyright and may not be reproduced, modified or distributed without the consent of the copyright owner. Except for any liability which cannot be excluded, Chant West does not accept any liability whether direct or indirect, arising from use of the data. Past performance is not an indication of future performance. Refer to www.chantwest.com.au for full details on Chant West’s research methodology, processes and FSG.